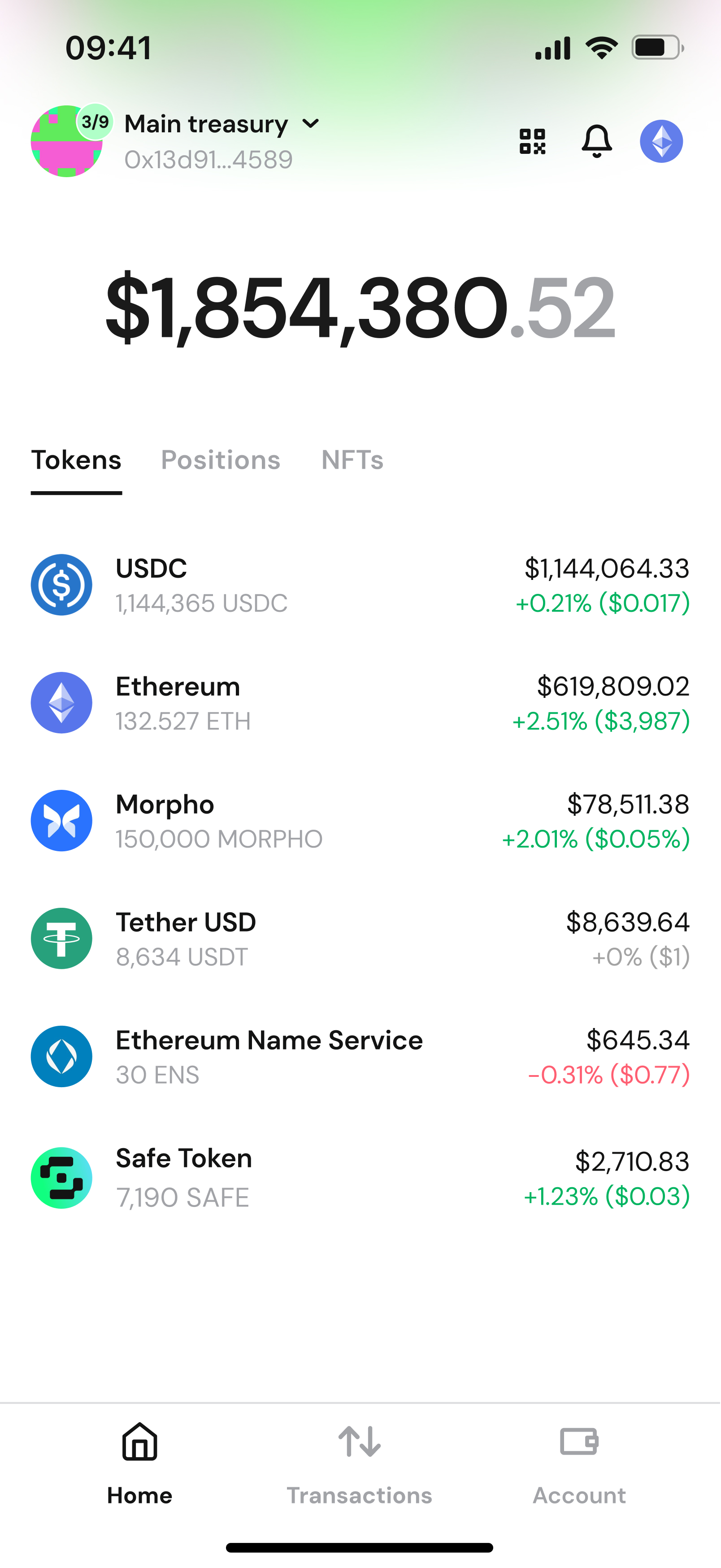

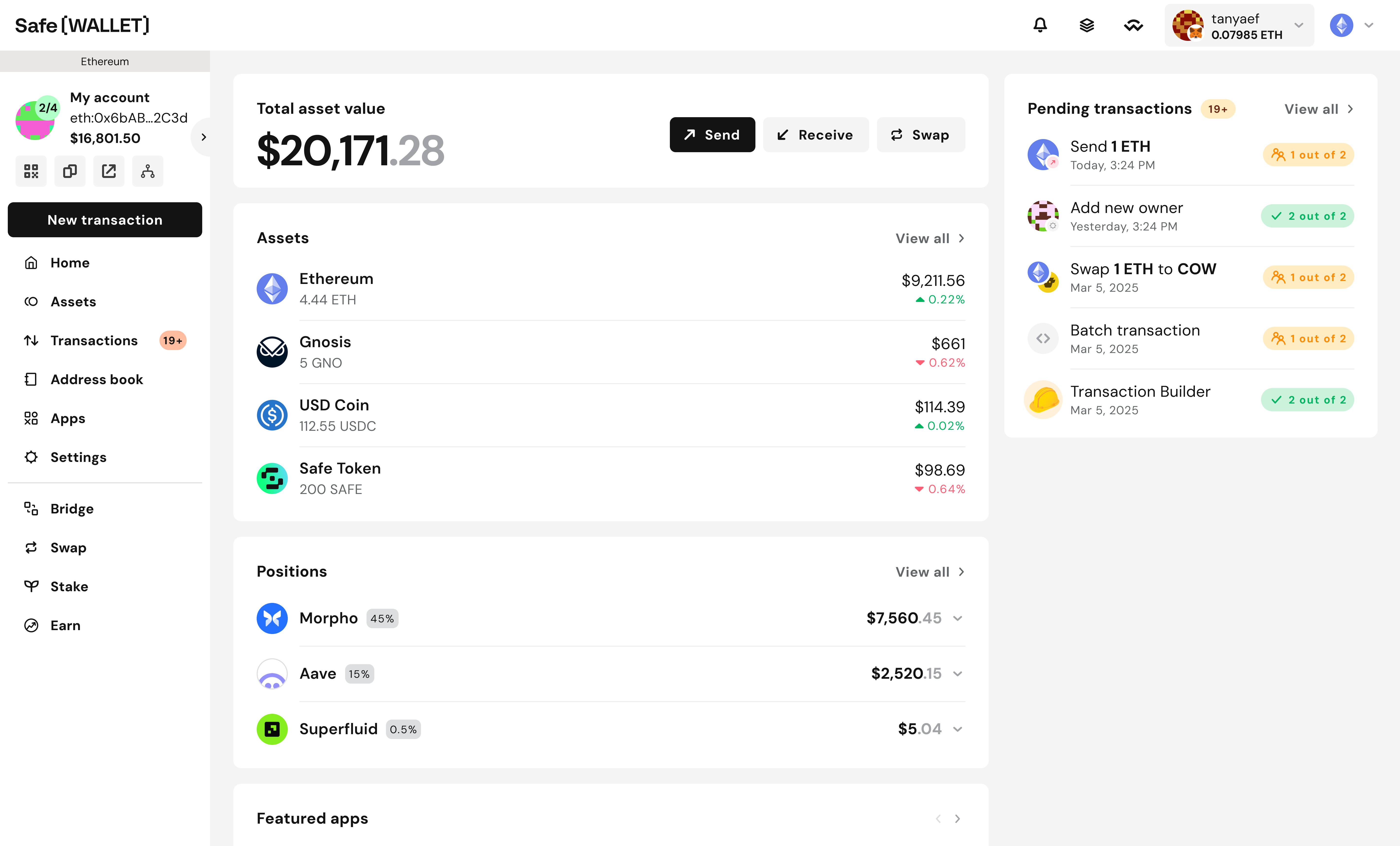

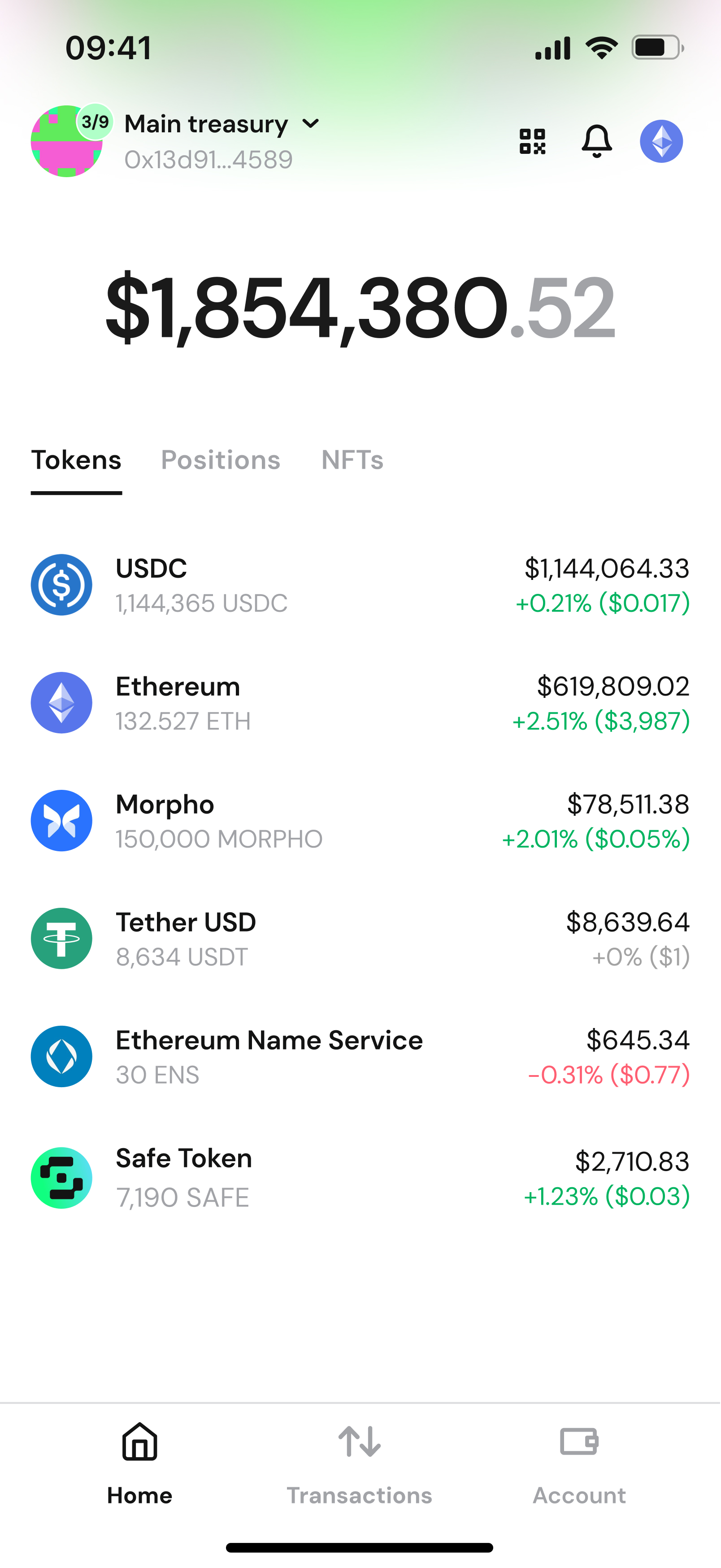

Multisig security for your onchain assets

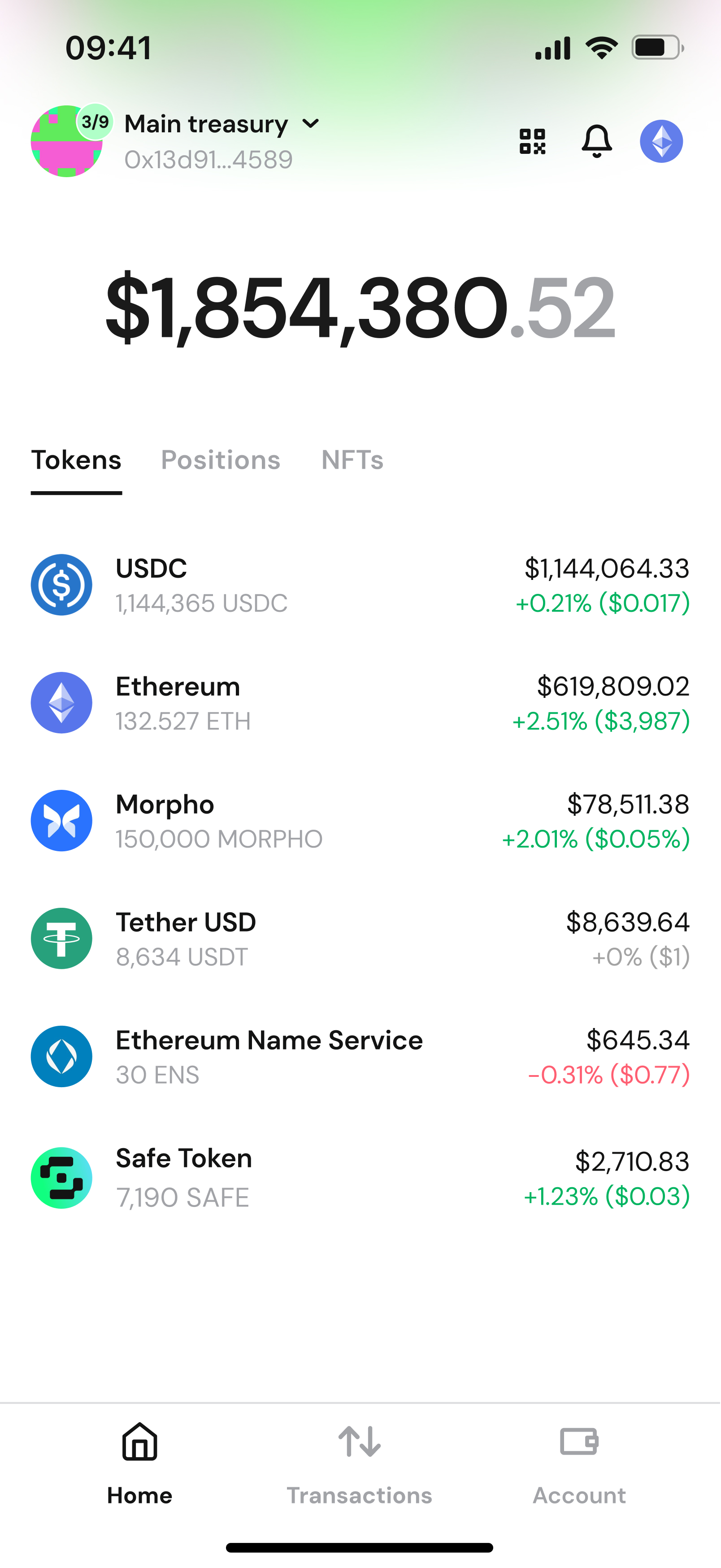

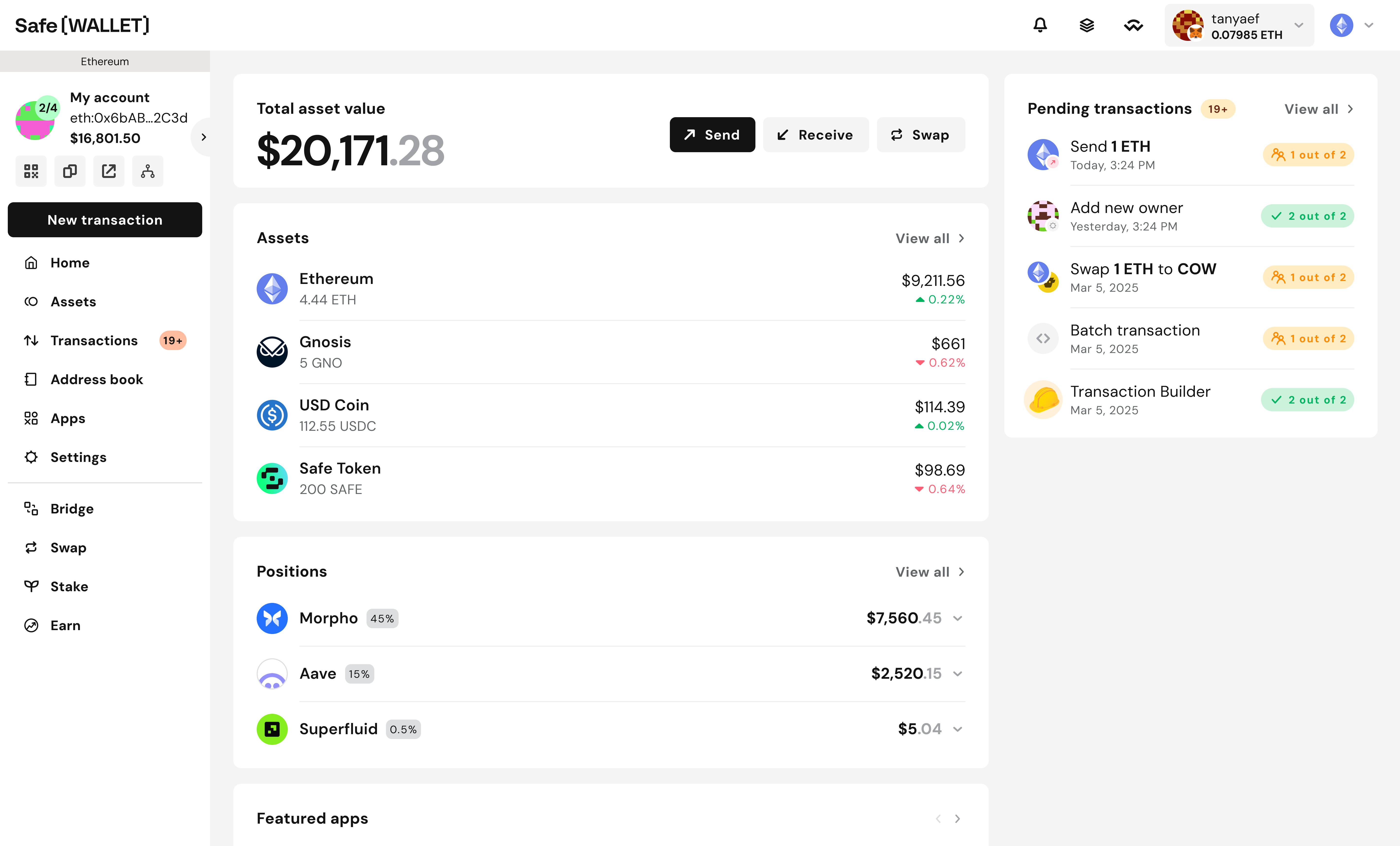

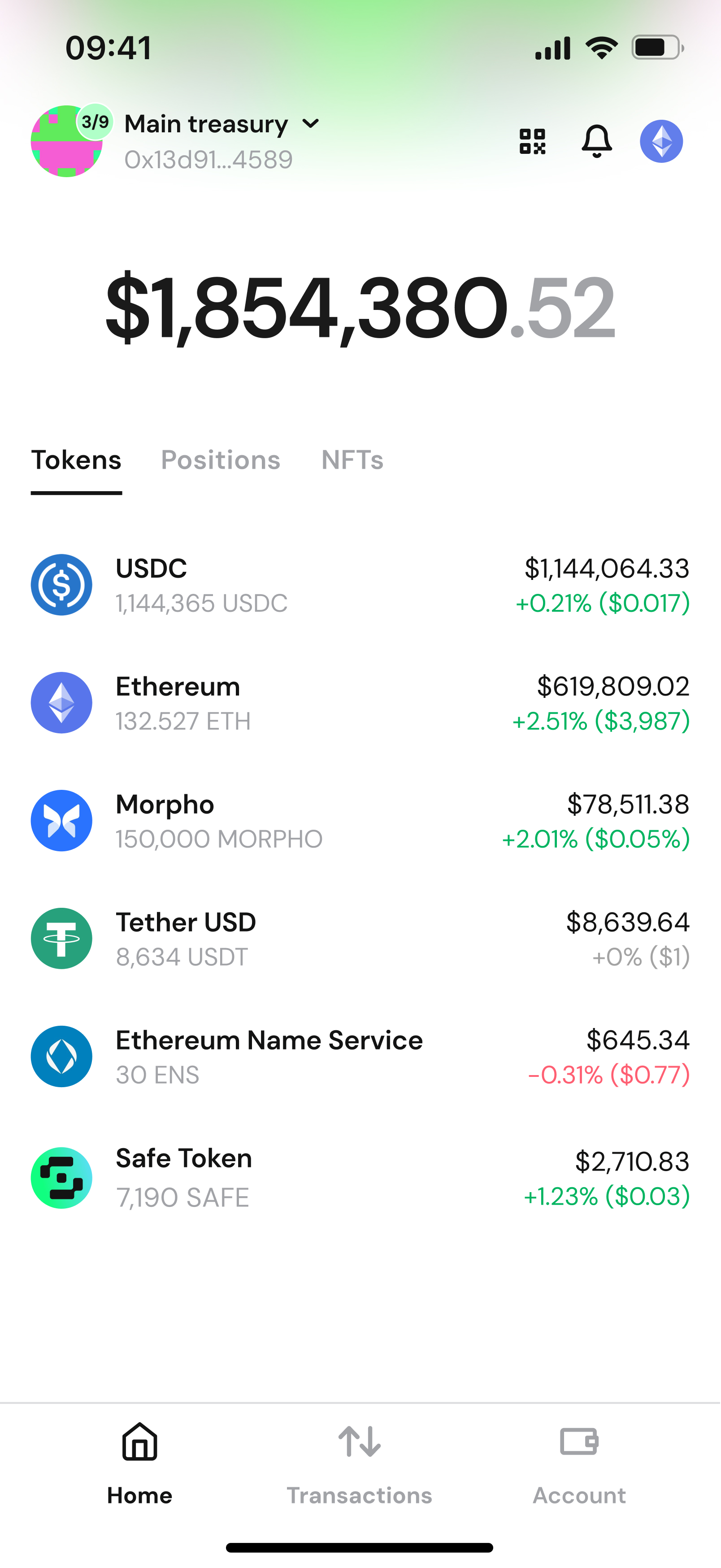

Eliminate single point of failure. Distribute access control across multiple owners

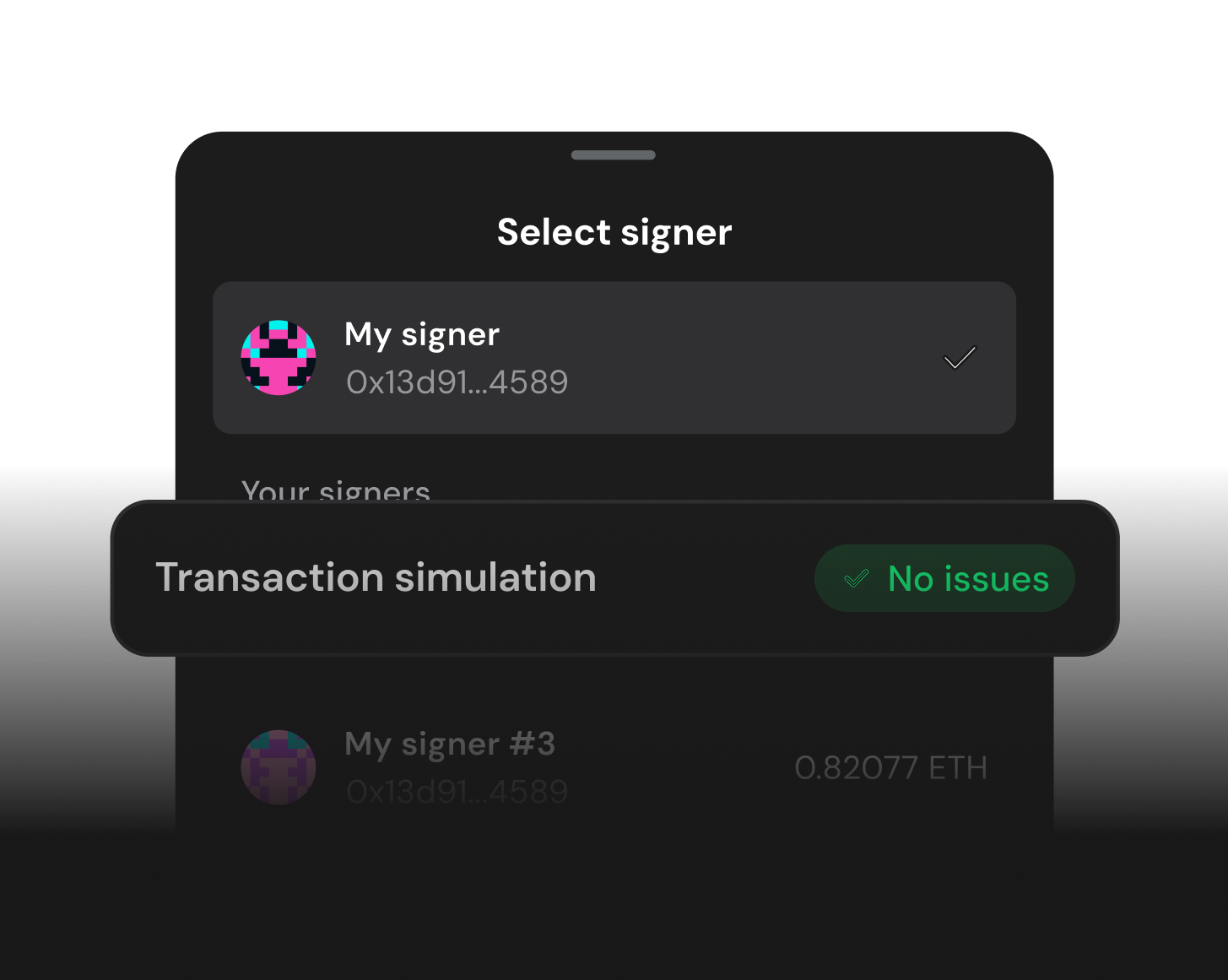

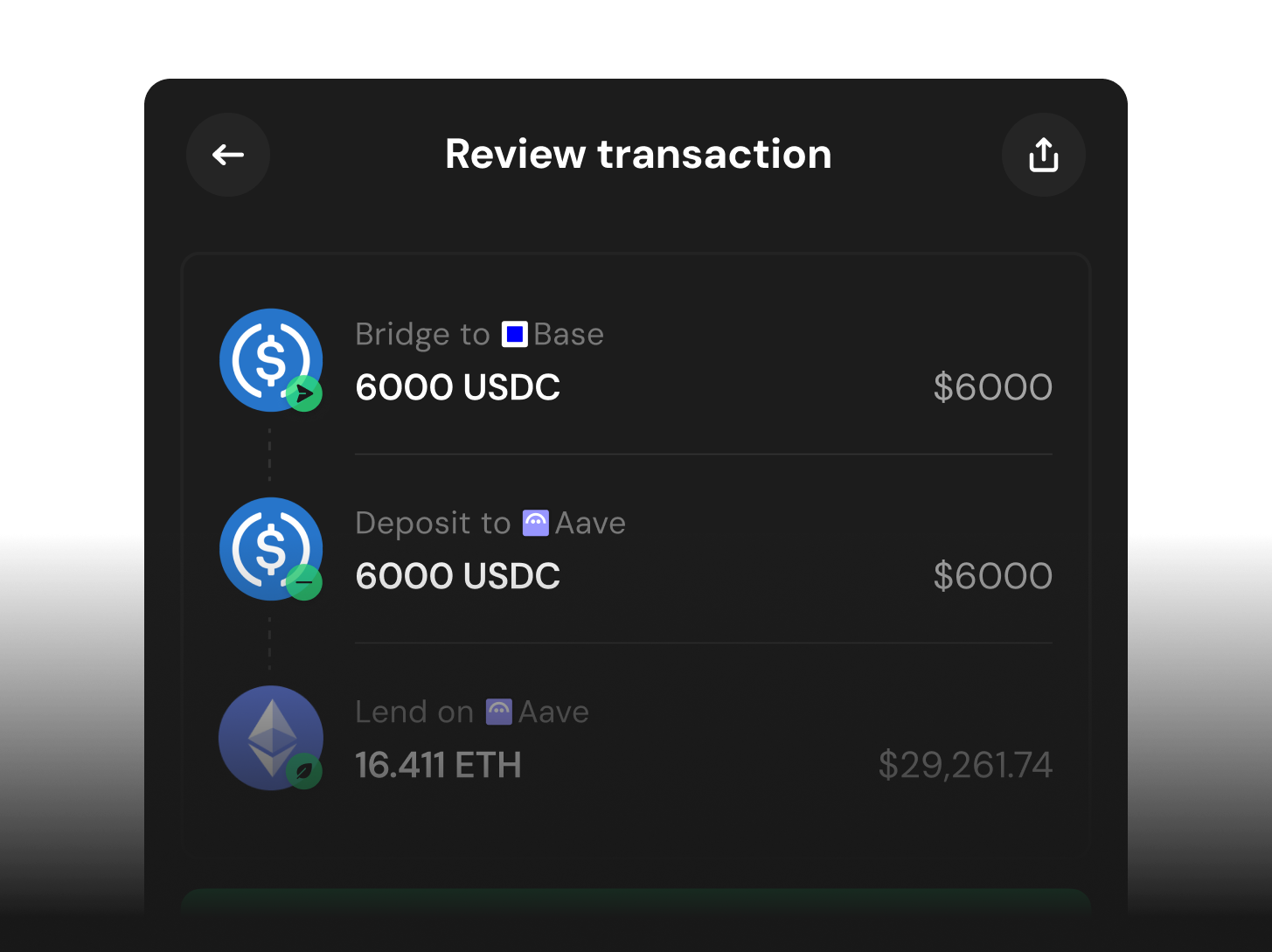

Scan risks and simulate transactions before they execute

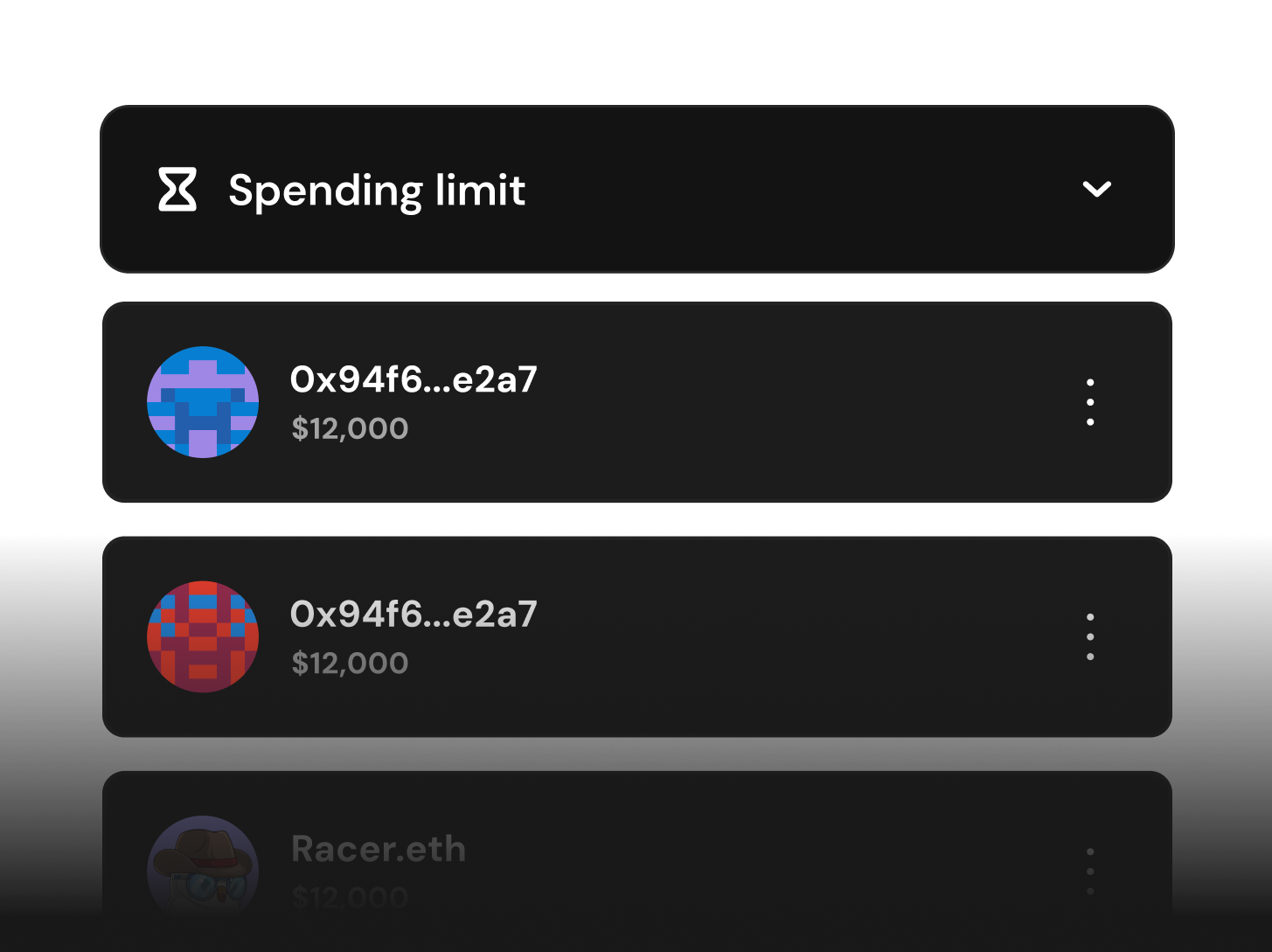

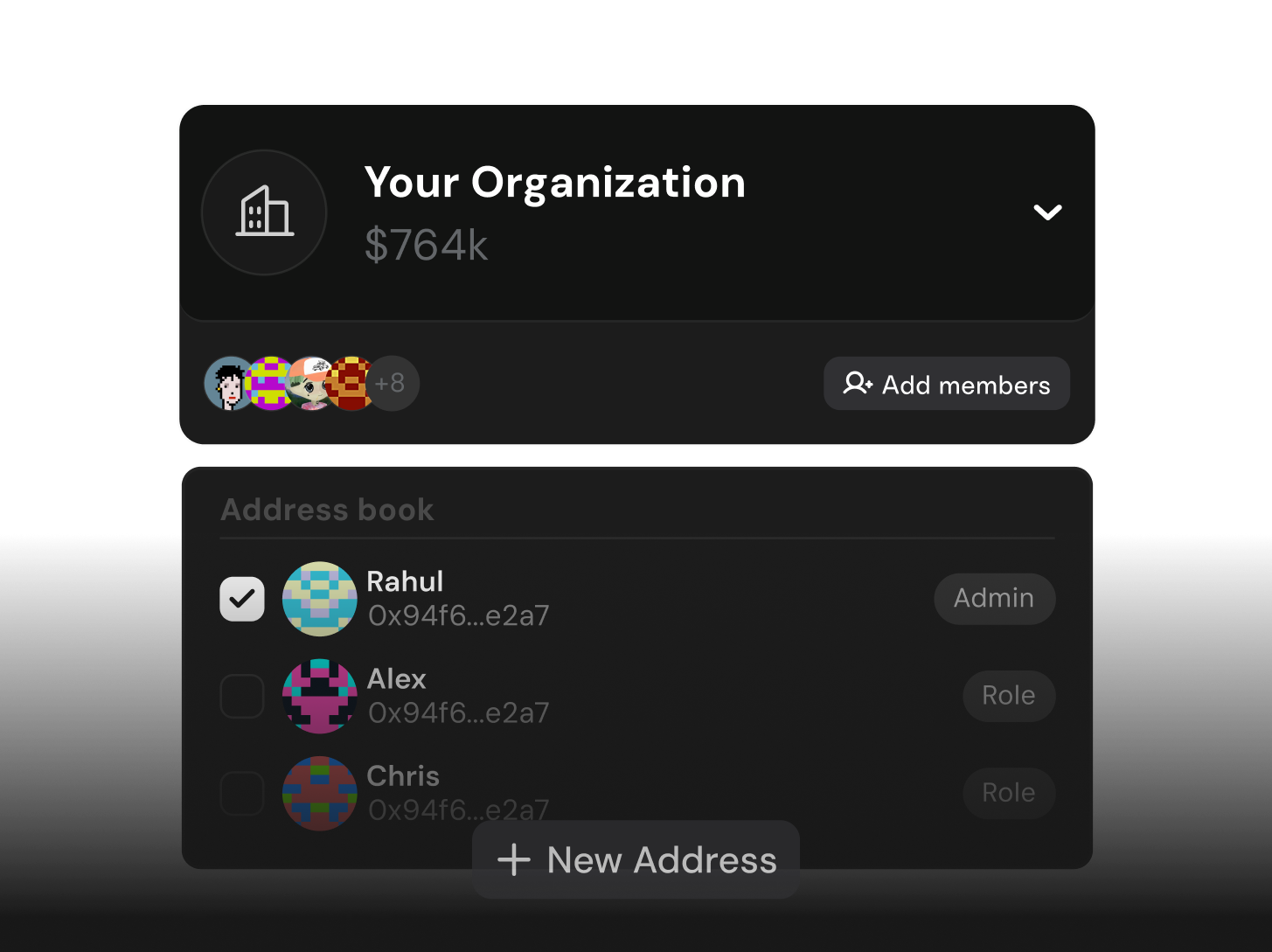

Set daily spending limits, approval thresholds and role-based access

Invite team members to manage and track multi-chain Safe accounts together

Cut gas costs by bundling complex transactions into one signing step

No single point of failure

Defend against private key compromises and setup thresholds

Formally verified contracts

Safe is among the most audited and battle-tested contracts on Ethereum.

Open source

No black box for your treasury. Independently verify all changes

Trustless recovery

Never loose access to your account by nominating a guardian

Safe, like Morpho, makes security its top priority. That's why we see strong alignment and confidence using Safe for Morpho's daily operations across multiple networks, making it a key building block of our operational stack.

Merlin Egalite, Co-Founder Morpho Labs

World Foundation relies on Safe Wallet to securely manage critical operations and transactions. Safe Wallet's flexibility allows additional protections for users, optimization of transaction fees and entirely new mechanisms like priority blockspace for humans.

Safe is an important part of the Ethereum ecosystem. The EF is an active Safe{Wallet} user, as it aligns with our "DeFiPunk" ethos and open-source, local-first, permissionless, and non-custodial ideals.

Safe makes managing crypto assets secure, reliable, and easy. Whether you're working solo or with a team, the multisig setup and intuitive interface give us full control and peace of mind. It's the gold standard for smart contract wallets.

Safe, like Morpho, makes security its top priority. That’s why we see strong alignment and confidence using Safe for Morpho’s daily operations across multiple networks, making it a key building block of our operational stack.

I use a multisig (safe) for >90% of my personal funds. M-of-N, some keys held by you (but not enough to block recovery), the rest held by other people you trust. Don't reveal who those other people are, even to each other.

100% true Safe is the backbone of the crypto industry. They should be celebrated more.

We’ve been using Safe for everything from protocol upgrades to treasury management for over four years. Their multisig setup, combined with guards and modules, gives us the right balance of security and flexibility.

We’re excited about how our strategic alliance with Safe is advancing the secure, user friendly account abstraction that’s needed for the mass adoption of Web3. Safe’s modular infrastructure, combined with the industry-standard Chainlink oracle platform, has created a strong foundation for making blockchain applications more accessible and resilient. It’s been great to see our work together mature into real adoption that drives our industry forward

i need to count how many safe wallets we have (its a lot)